Main navigation (level 2) (loaded programmatically)

Today, we already produce more than 15 TWh of hydrogen in Belgium by using the Steam Methane Reforming (SMR) process to crack natural gas. Roughly nine kilograms of CO2 are released per kilogram of hydrogen produced. This so-called grey hydrogen is used in petrochemicals for the production of ammonia, hydrochloric acid and hydrogen peroxide, for polymerisation reactions and for the desulphurisation process.

Achieving net zero greenhouse gas emissions by 2050 while safeguarding these sectors and industrial processes in Belgium requires a well-thought-out roadmap. To do this, we need to widen our perspective to include at the very least, neighbouring countries. Industry clusters in the Netherlands, northern France and North Rhine-Westphalia use more than 65 TWh of hydrogen in similar processes.

Priority: scaling up green electricity

During the production of green hydrogen – through electrolysis of water with renewable electricity – no greenhouse gases are released. Of course, sufficient green electricity has to be available. Let that then be a challenge in Belgium and Europe in the coming decade.

The recent PATHS2050 study by EnergyVille includes various scenarios for a climate-neutral Belgium by 2050. It shows which steps we will have to take and at what costs. The race towards electrification of the energy demand is already manifesting itself today in the transport sector and in the heating of buildings, and will be evident in various industrial processes from 2030.

In the recently published ‘Powering industry towards net zero’, Elia also shows that – in every possible scenario – the electricity demand will more than double between now and 2050.

A higher demand for electricity means a necessary rapid growth of renewable electricity production, because in addition to making the current demand green, the increasing demand must also be met. ‘PATHS2050’ teaches us that the capacity of solar panels needs to quadruple by 2030, and that energy from wind (land and sea) needs to double. And this in a scenario that didn't yet take into account the production of green hydrogen.

Demand for emission-free – instead of green – hydrogen

Europe is strongly committed to greater green hydrogen production by 2030 and is adjusting policy accordingly. But in the short term, we will not have access to the green electricity required for this. Furthermore, Belgium has a structural shortage of renewable electricity sources, which means that large-scale investments in ‘electrolysers’ are not possible.

In addition to the increasing electricity demand for transport, heating and industrial processes, we will also have to meet the current and future hydrogen demand without greenhouse gas emissions. Just as in our neighbouring countries, the scenarios stipulate a falling hydrogen demand in refineries, but an increase in the steel sector, possibly in the chemical industry, and certainly in international shipping and aviation.

There will be economic potential in investing in the production and use of ‘blue hydrogen’ by 2030. The extent of this will depend on natural gas and carbon prices (CO2 price under ETS). Blue hydrogen is obtained by cracking natural gas using the SMR process, capturing the CO2 emissions and storing them underground. But Belgium cannot store CO2 emissions underground and will therefore have to rely on storage in empty gas fields in the Dutch North Sea or in Norway.

Transport infrastructure is crucial and offers opportunities for Belgium

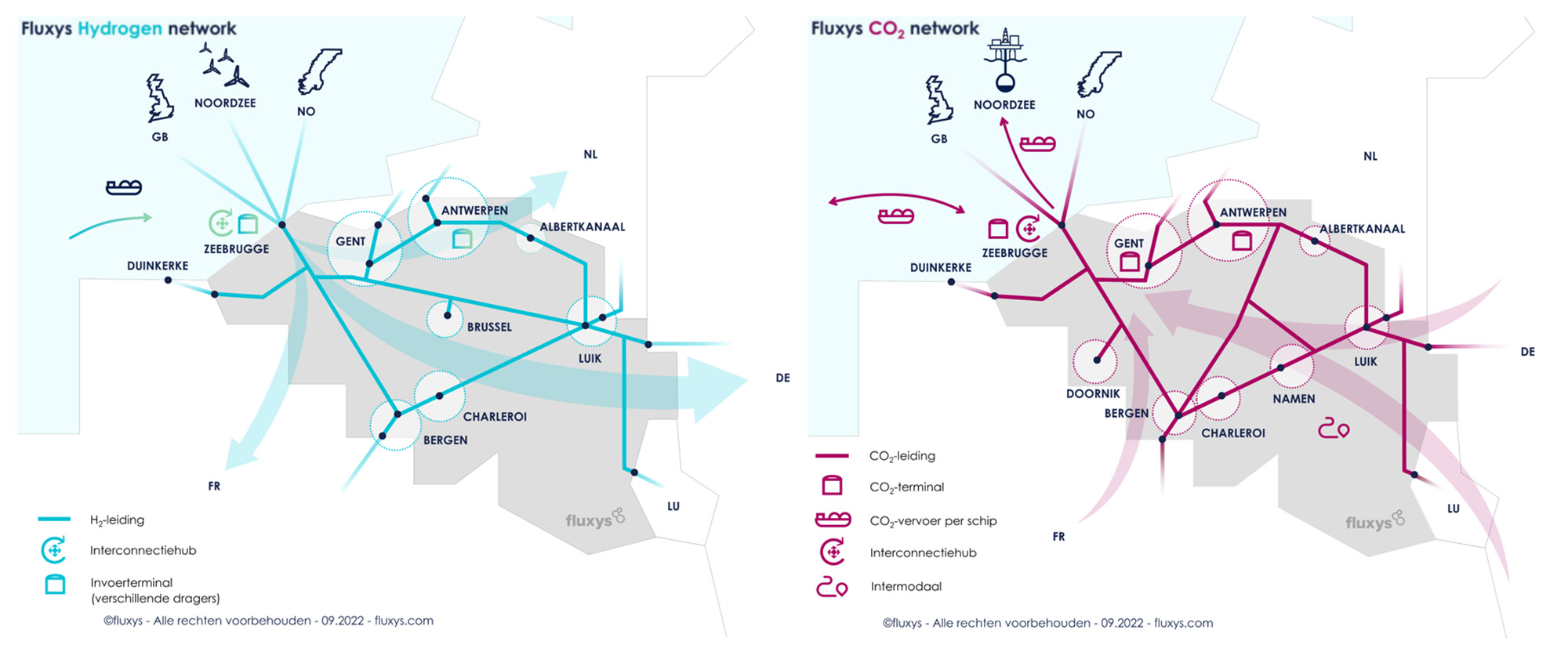

The construction of a CO2 pipeline connecting industrial sites is essential for the transport of CO2 emissions from the blue hydrogen production process and from captured CO2 emissions from sectors that are difficult to decarbonise, such as the cement sector. The scenarios in PATHS2050 show that we will have to capture and store approximately 20 Mton of CO2 for Belgian industry and refineries by 2030, and therefore transport it abroad.

Belgium is ideally situated to play an important logistical role in the burgeoning global hydrogen economy. This concerns the import of hydrogen from countries with a greater potential for cheaper renewable electricity and hydrogen production. We have already entered into collaboration intentions with such countries as Oman, Namibia and Chile, which will hopefully lead to hydrogen production and transport in the medium term.

Perhaps the generated energy will not come to Belgium in the form of hydrogen molecules, but rather as ammonia (NH3). After all, ammonia has a higher energy density than hydrogen, meaning that one ship with an ammonia cargo has the same energy density as three ships of liquid hydrogen.

Other carbon-containing molecules such as methane (CH4) or methanol (CH3OH) can also be used for hydrogen transport. It is not yet clear which molecule it will eventually be. It will be important to follow developments closely, because the construction of infrastructure, storage and transhipment sites and pipelines is also crucial for this.

A roadmap is essential

Producing or importing hydrogen is the first step, but then the energy still needs to be distributed to the end users. Except for Air Liquide's private pipelines, Belgium has no transmission or distribution pipelines. Following a survey of the industry, Fluxys recently published a roadmap with a view on hydrogen and CO2 pipelines at industry cluster level. This roadmap links hydrogen demand with hydrogen production in the cluster or the import from neighbouring countries.

In order to make the energy transition feasible and affordable for our industry, a huge number of processes will have to be properly coordinated. These include correct timing, dimensioning and localisation of transmission capacity routes for electricity, CO2 and hydrogen, for instance. This not only needs to be properly worked out in Belgium, but the connection with our neighbouring countries will also be crucial.

EnergyVille (VITO and KULeuven) is collaborating with Belgian scientific partners, ELIA, Fluxys, TNO (Netherlands) and Dechema (Germany) in the Energy Transition Fund project TRILATE. TRILATE must quantitatively substantiate the infrastructure challenge, an essential step before the real work begins …

Pieter Lodewijks

Program Manager VITO/EnergyVille