Main navigation (level 2) (loaded programmatically)

Cleantech has developed into an umbrella sector covering organisations that tackle a wide range of environmental issues across various industries. 'Energy and energy efficiency' as a sector has grown considerably in importance and prominence in recent years. Due to the increased consumer demand for environmentally friendly technology, there are more opportunities for entrepreneurs to develop and market new, cleaner technologies that require less energy and resources.

In contrast to many countries where the cleantech industry is only an emerging market with emerging innovation and a limited number of players, Europe and the US already enjoy a healthy and mature cleantech market with advanced technology and robust ancillary industries. However, entrepreneurial activity and investor support in Europe has declined overall. When seen in this context, Flemish cleantech companies are doing well and are continuing to attract investment.

Innovation is closely linked to cleantech. According to a study by the University of Gothenburg in Sweden (2019), cleantech start-ups are more likely to develop cutting-edge technology and introduce new market innovations than start-ups not related to cleantech. They do however depend more on government support and for that reason, cleantech also relies strongly on R&D.

The landscape of R&D is changing thanks to competitive pricing compared to fossil fuels and a strong desire on the part of governments, organisations and consumers to create a greener and more sustainable environment.

Future needs of cleantech R&D

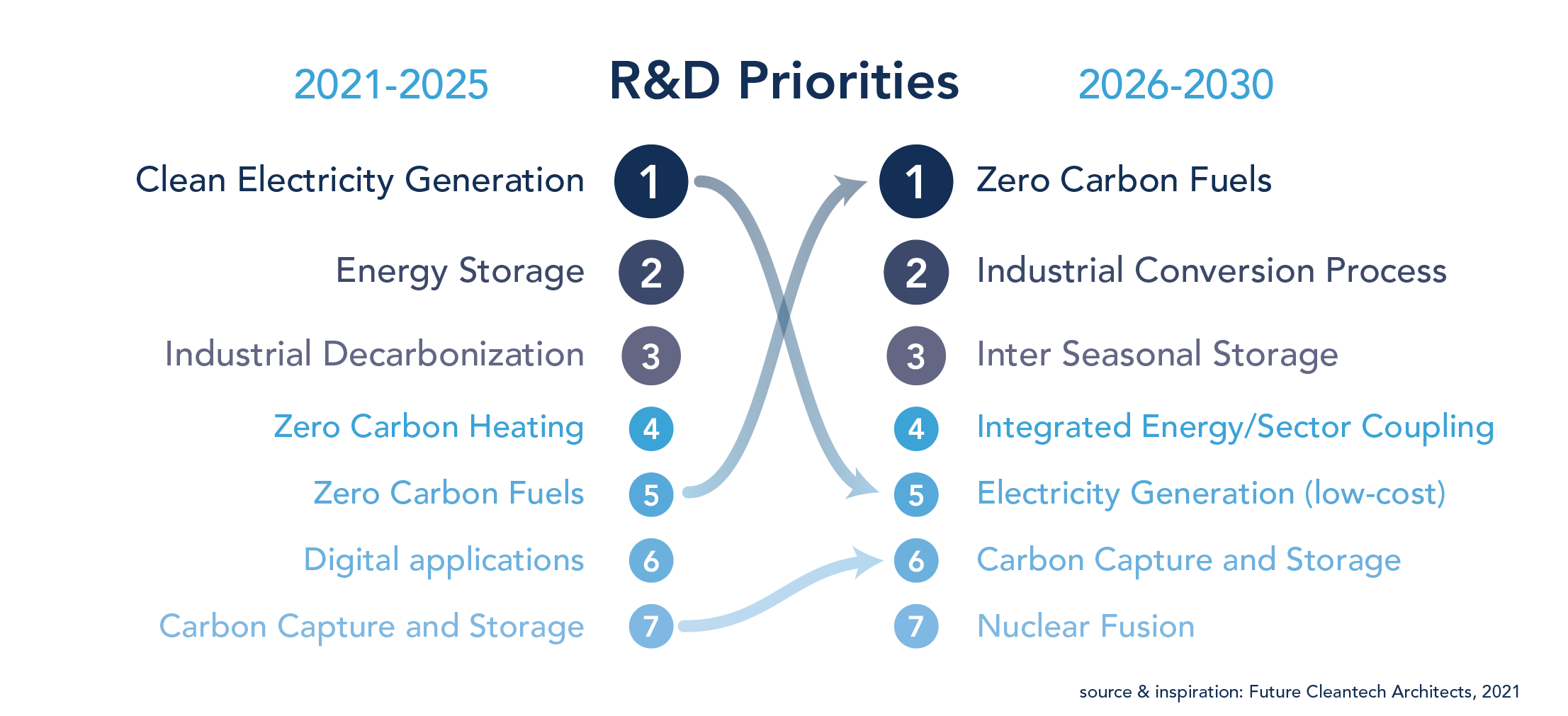

In the survey carried out by the ‘Future Cleantech Architects’ (FCA), experts identify any gaps still present in the development of technologies and processes that have the potential to reduce emissions fast. While energy storage, zero-carbon fuels and industrial processes are among the top priorities, segments like carbon capture and storage (CCS) and digital tools not only rank lower, but are regarded as controversial.

In the short term, the main R&D priority is the energy transition and anything closely related to it.

However, FCA survey participants seemed confident that the challenge of generating clean electricity would be overcome by 2025. Subsequently, the report concluded that "the R&D priority is shifting towards low-cost zero-carbon fuels and conversion processes in the industrial decarbonisation segment".

As a result, clean energy generation, storage technologies and decarbonisation are expected to be the key R&D areas up till 2025. For 2030, zero-carbon fuels, conversion processes and inter-seasonal energy storage are expected to be amongst the key R&D areas.

The results with regard to the key drivers beyond 2030 paint a more ambitious and visionary picture. For that period, survey respondents anticipate innovative technologies ranging from precision agriculture to carbon capture to play a bigger role, as well as more advanced market design. In addition, they expect the next generation of existing technologies that have already proved their usefulness to take over, and predict that hybrid versions (such as farming photovoltaics) will become increasingly important.

The gaps identified by the Future Cleantech Architects (FCA) are focused on developments in:

- hydrogen - where the cost of electrolysers and clean electricity needs to be reduced,

- cement - where it is apparent that building standards must be modernised,

- aviation.

This research therefore implies the need to devote more attention to carbon capture, use and storage and zero-carbon fuels in the next five years.

Deploying the cleantech hype cycle in Flanders

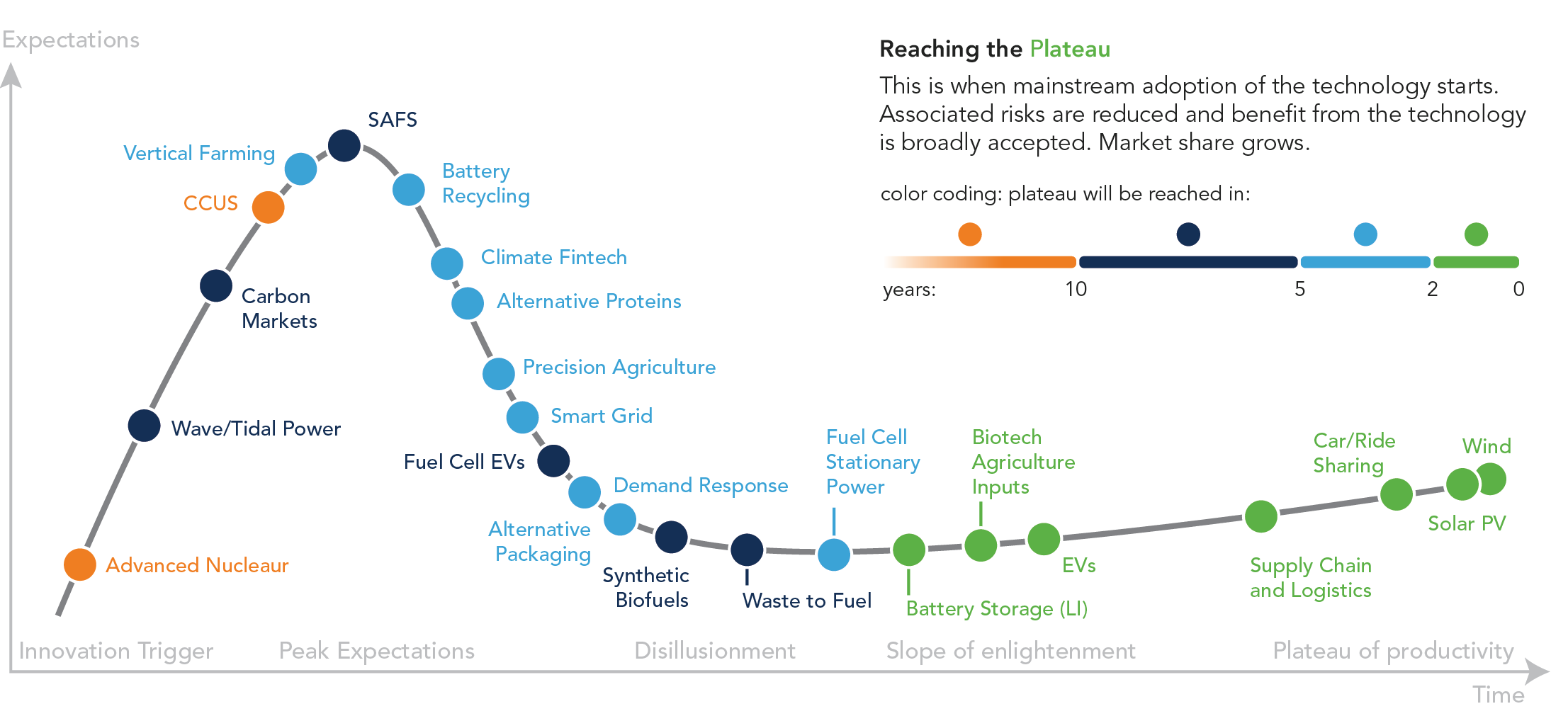

The Gartner hype cycle is often used as a graphical representation of the maturity, adoption and social application of emerging technologies. This methodology describes how these technologies are potentially relevant to solving real business problems and exploiting new opportunities. It provides a view of how a technology or application will progress through five stages over time.

1. ‘Innovation trigger’: A potential technology breakthrough kicks things off. Early proof-of-concept stories and media interest trigger significant publicity. Often no usable products exist, and the commercial viability is not yet proven.

2. ‘Peak expectations’: Early publicity produces several success stories — often accompanied by dozens of failures. Some companies take action; many do not.

3. ‘Disillusionment’: Interest wanes as experiments and implementations fail. Technology producers experience periods of difficulty or even go bankrupt. Investments only go through when providers improve their products to the satisfaction of the early adopters.

4. ‘Slope of enlightenment’: More instances of how the technology can benefit an enterprise start to crystallize and become more widely adopted. Technology providers are developing second and third-generation products. More businesses fund pilots, whereas conservative companies remain cautious.

5. ‘Plateau of productivity’: Mainstream adoption slowly starts to take off. Criteria for assessing the viability are more clearly defined. The broad market applicability and relevance of the technology are clearly paying off.

Cleantech has matured considerably since the initial boom around 2010. Conditions then were less favourable for the sector due to long, complex and expensive technology development cycles combined with falling natural gas prices and strong competition from overseas. Nowadays, battery, wind and solar technologies have reached the scale necessary to supply energy at costs that are competitive with energy from fossil fuels. Advances in renewable energy technology have laid the foundation for a range of climate tech innovations that still consume a lot of energy, yet help avoid the use of energy derived from fossil fuels. A good example of that is green hydrogen production.

In the evolving cleantech R&D landscape, similar trends can be observed in the hype cycle. If we assume, for example, that challenges in clean energy generation like wind and solar technologies can be overcome by 2025, we can then also assume that these technologies will reach the plateau of productivity by 2030.

Energy storage and industrial decarbonisation technology are ranked respectively as the second and third short-term R&D priorities (until 2025). We can therefore assume that technologies such as battery recycling, smart grid, waste-to-fuel and battery storage are correctly positioned on the hype cycle in the image above.

Almost every technology visible on the hype cycle above features in cleantech companies in Flanders. While you would expect more companies to be on the right of the hype cycle, i. e. in the last two phases, it is worth pointing out that there are also Flemish companies on the left who are developing technologies that act as innovation drivers and generate peak expectations.

The innovative nature of Flanders derives from the strong presence and involvement of higher educational institutions and research centres along with non-academic research institutes in the main cleantech hubs in the region. For example, Ghent, Antwerp and Leuven, the top three Flemish cleantech hubs, are home to more than 15 academic institutes and research centres related to cleantech.

R&D in Flanders and Belgium

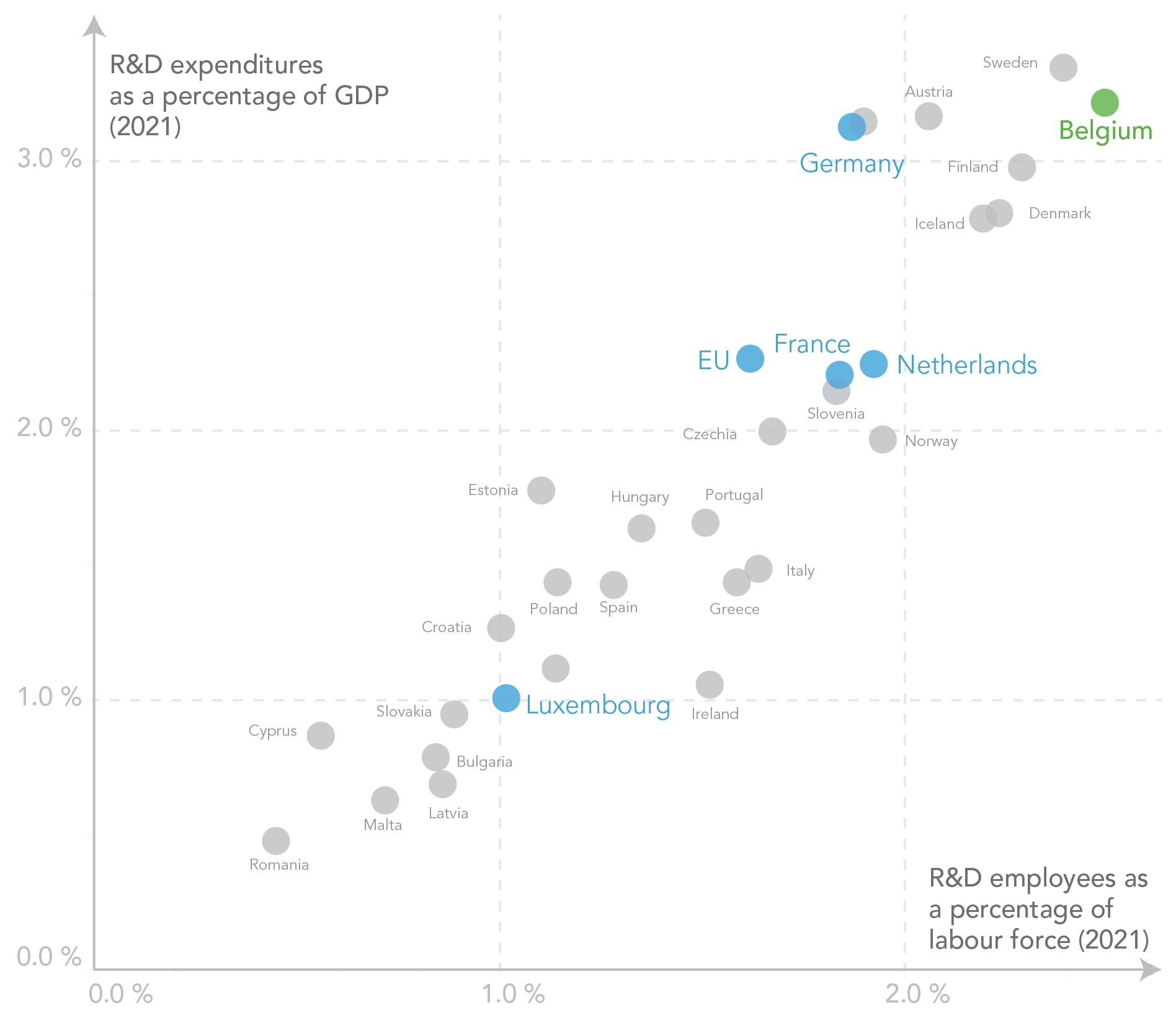

Belgium leads the field of R&D in Europe, both in terms of relative expenditure and the number of employees.

sources expenditures: Eurostat (online data code: rd_e_gerdtot) and OECD database:

https://ec.europa.eu/eurostat/databrowser/view/RD_P_PERSLF__custom_4019714/default/table?lang=en

According to Eurostat, Belgium currently has the second highest R&D spending in the EU (as a percentage of GDP) and the second highest percentage of the population active in this field. According to this data, Belgium is making faster progress in this field than the EU average. Belgium devotes roughly 3.5% of GDP to R&D, aspiring to reduce the impact of industry on the environment. Flanders devotes slightly more, with 3.6% of GDP going to R&D in 2020.

The high quality of education and research facilities, the availability of skilled workers and numerous R&D tax incentives in Belgium (source: Flanders Investment and Trade) all mean that many companies relocate to this area to carry out their research activities.